Tech industry funds to spur stockpile replenishment and boost Pentagon in 2025 budget.

- Pentagon requests $500 million for stockpile replenishment, aiming to spur tech industry

- Funding request tied to supplemental funding stalled in Congress, with focus on China as pacing challenge

- Budget documents outline $10 billion for ballistic missile activities, cyber operations support, and autonomous systems

- Senate supplemental bill includes $1.9 billion for Taiwan, while House proposes smaller $66 billion bill

- 2025 budget allocates $142 billion for R&D, $17 billion for advanced technologies, and $144 million for innovative startups

Pentagon’s Focus on Stockpile Replenishment and Tech Industry Funds in 2025 Budget

The Pentagon’s recent budget request for 2025 reveals a strategic focus on stockpile replenishment and funds aimed at spurring growth in the tech industry.

Read moreQuorum Club Funding: Gruhas Leads Pre-Series A Investment in Hospitality Brand

- Quorum Club secures pre-Series A funding led by Gruhas

- Founded in 2018 by Vivek Narain and Sonya Jehan

- Operates three brands: Quorum, District 150, and Business Quarter

- Recent news includes Amazon’s India strategy and Tata Motors’ performance

- Subscription options available for full access to content

Quorum Club Secures Pre-Series A Funding from Gruhas

Quorum Club, a prominent hospitality brand founded in 2018 by Vivek Narain and Sonya Jehan, has recently made headlines by securing pre-Series A funding led by Gruhas. Read more

Atlassian Acquisition Strategy Strikes Gold: Snags US Tech Star at $790m Discount

- Atlassian acquired Loom at a $790m discount to its 2021 valuation after four years of initial disinterest from Loom’s CEO.

- Loom’s founders advised Australian entrepreneurs to embrace “down rounds” and buyouts below valuations in the current tech funding downturn.

- Loom’s growth slowed post-pandemic, leading to job cuts and borrowing before Atlassian’s acquisition.

- Atlassian’s acquisition of Loom for $975 million in cash and stock provided access to new user bases and marketing teams.

Sydney Start-Up Struggles: Senior Staff Exodus Amid High-Value Challenges in Scaling

- Sydney start-up Dovetail struggles to scale, facing senior staff exodus

- Company raised $89 million but faces challenges retaining key engineering staff

- Co-founder Bradley Ayers resigned in February, cashed out $9.5 million during funding round

- Dovetail’s customer research software faces churn issues with clients like Bunnings and Deloitte

- Despite challenges, Dovetail plans expansion but faces delays in moving to new headquarters

Sydney Start-up Struggles to Scale Amid Senior Staff Exodus

In the fast-paced world of tech start-ups, the journey to success is often riddled with challenges. Read more

Battery Tech Funding: Lohum Secures Impressive $14 Million Investment

- Battery tech firm Lohum secures $14 million in funding from Singularity Growth, Vyoman India, and Baring Private Equity

- Mumbai-based Singularity Growth, backed by CaratLane founder Mithun Sacheti, leads the funding round with Rs 55 crore

- Vyoman India contributes Rs 11 crore, while Baring Private Equity adds Rs 10 crore to the funding

- Filings with the Registrar of Companies (ROC) confirm the investment amounts from the different backers

- The funding round highlights the growing interest and support for battery technology advancements

Battery Tech Firm Lohum Raises $14 Million in Funding

Battery tech firm Lohum has recently secured $14 million in funding, marking a significant milestone in their growth journey. Read more

Kimbal Technologies Funding Round Secures $5 Million Led by Niveshaay

- Kimbal Technologies secures $5 million in funding round led by Niveshaay

- Funds to be utilized for expanding operations and developing new products

- Aim to establish a modern power distribution system to the last mile

- Energy tech startup Kimbal Technologies announces funding for growth

- Company plans to innovate in the energy sector with new products

Kimbal Technologies Secures $5 Million in Funding Round Led by Niveshaay

Kimbal Technologies, an innovative energy tech startup, has successfully raised $5 million in a recent funding round led by Niveshaay. Read more

Green Tech Funding Dilemma at Asia Green Tech Summit: Is Sustainability Being Held Back by Lack of Funds?

- Green Tech Funding remains a critical challenge in Asia, as highlighted at the Asia Green Tech Summit.

- VinFast, a Vietnamese company, is leading the way in electrifying public transit to promote sustainable urban development.

- Decarbonization Partners and Hoi Ping Ventures emphasize the importance of strong fundamentals and financial support from traditional institutions for green technology ventures.

- The Asia Green Tech Summit discusses the potential of hydrogen as an alternative energy source and the need for a unified regional approach to sustainability.

Alberta Grant Programming Injects $20M to Empower Graduates Innovating New Technologies

- Alberta government invests $20 million in grant programming for graduates creating new technologies

- Funding supports STEM graduates in entrepreneurship, business skills, and technology commercialization

- Innovation Catalyst Grant program fosters collaboration between post-secondary institutions and industry

- Program aims to create 20,000 new jobs and increase tech companies’ revenue by $5 billion by 2030

- Partner universities administer program, providing mentorship and resources for tech start-ups in various sectors

Alberta Grant Programming: Investing in Innovation

The Alberta government recently announced a significant investment of $20 million in grant programming to support graduates who are paving the way in creating new technologies. Read more

Falcon LLM startup emerges from stealth with $20 million in funding for groundbreaking new venture

- Falcon LLM startup Adaptive emerges with $20 million funding led by Index Ventures

- Adaptive aims to help companies train large language models tailored to their specific needs

- Seed investment also includes participation from ICONIQ Capital, Motier Ventures, and others

- Adaptive focuses on reinforcement learning from human feedback to improve LLM responses

- Platform allows for ongoing learning from user interactions and offers RLAIF process for model training

Introducing Falcon LLM Startup: Team Emerges from Stealth with $20 Million Funding

Adaptive, a startup founded by the team behind the open source large language model Falcon, has recently emerged from stealth mode with an impressive $20 million in funding, led by Index Ventures. Read more

Full-Stack AGI Funding Secured from Jan Koum’s Newlands VC to Propel SuperAGI’s Ambitions

- SuperAGI secures $10 million in funding from Jan Koum’s Newlands VC to support its full-stack AGI goals

- The startup aims to develop a full-stack AGI platform using Large Agentic Models (LAMs) to address limitations of current Large Language Models (LLMs)

- SuperAGI’s research has gained traction with 20,000 developers, including those from major companies like Microsoft, Google, and Tesla

- The funding will be used for further research, middleware, and software applications to enhance AI capabilities across various use cases

- SuperAGI’s open-source infrastructure has attracted attention from industry giants and is being used to create innovative AI applications, with plans to expand its reach globally and become a top AI research company.

Start-Up Funding Tips Unveiled: Insider Advice From the Trenches

- Many technology venture capitalists (VCs) are self-assured due to their wealth and entrepreneurs seeking funding, rather than their expertise in technology.

- Engaging VCs in conversations about emerging technologies can reveal their limited knowledge in disruptive technologies and macro trends.

- VCs excel in valuation models, legal aspects, and deal modifications, relying heavily on networks and relationships for success.

- Entrepreneurs should understand the financial incentives driving VCs, focusing on relationships, performance, advocacy, knowledge, and professional integrity when selecting a VC.

A91 Partners Fund poised to shatter records with $700-750 million target raise

- A91 Partners Fund is set to raise its largest fund at $700-750 million

- Launched in 2018, A91 Partners initially had a $350 million maiden fund

- A91 Partners scaled up quickly, securing $550 million for their second fund in just three years

- The fund targets late-stage venture and early-growth investments

- This rapid increase in fund size is one of the fastest in the domestic investment fund landscape

A91 Partners Fund: A Journey of Growth

A91 Partners, a prominent player in the Indian investment landscape, is making headlines with its ambitious goal of raising its largest fund yet, targeting an impressive $700-750 million. Read more

“Tech-Enabled SME Lending Soars with ProCredit’s $4.1 Million Pre-Seed Funding Boost”

- ProCredit, a Philippines-based SME lender, secured US$4.1 million in pre-seed funding to advance tech-enabled SME lending, led by Integra Partners and involving various investors including the Menardo Jimenez Family Office and M Venture Partners.

- The founding team of ProCredit has extensive experience in SME lending, aiming to become a major player in the Philippines through innovative credit-first client engagements, rules-based underwriting, and a technology-driven approach to reduce costs and enhance customer experience.

Butler Tech Funding Secures State Funds for State-of-the-Art Welding Lab

- Proposed state funds in Sub. House Bill 2 will help Butler Tech expand its welding program, with over $231,500 allocated from the Strategic Community Investment Fund.

- The welding technology program at Butler Tech aims to address the demand for skilled welding professionals and offers students hands-on experience with the latest technology.

- Butler Tech assists students in finding co-ops and internships to enhance their skills and experience, with high job placement rates and starting salaries near $50,000 in the welding field.

Biotech spinout revolutionizes industry with £8.5m funding to commercialize groundbreaking technology

- Biotech spinout Wobble Genomics raises £8.5m to commercialize RNA sequencing technology

- Funding round led by Mercia Ventures and BGF, with support from IQ Capital, EOS Advisors, and Old College Capital

- Founded in 2021 by Dr. Richard Kuo, Wobble Genomics specializes in long-read RNA sequencing

- Technology enables detection of ‘full length’ RNA, offering applications in drug development, research, agriculture, and ecology

- Company operating in stealth mode, plans to double team size in two years; total funding raised exceeds £10.5m

Biotech Spinout Raises £8.5m to Commercialise its Technology

Wobble Genomics, a promising biotech spinout originating from the University of Edinburgh, has recently secured a substantial funding round of £8.5m. Read more

China Chipmaker Funding Surges to $27 Billion to Combat U.S. Sanctions, Big Fund III Set for Additional Rounds of Funding

- China initiates Big Fund III with $27 billion funding for chipmakers to counter U.S. sanctions

- Funding primarily sourced from local governments, state-owned enterprises, and central government

- Aim to make China self-sufficient in semiconductor sector, aligning with President Xi Jinping’s vision

- Fund to support local companies and finance multiple sub-funds for diversified investment strategies

- Big Fund’s expansion in response to U.S. efforts to restrict China’s access to semiconductor manufacturing technologies

China chipmaker funding to boost semiconductor industry

China has recently announced a significant move to bolster its semiconductor industry by allocating a substantial amount of funding to chipmakers. Read more

ESG Tech Stocks: Unleashing the Power of Mega-Cap Tech in Sustainable Funds – Discover the Impact!

- Mega-cap tech stocks dominate many ESG funds, including Nvidia, Amazon, Microsoft, Apple, Meta Platforms, and Alphabet.

- ESG funds aim to invest in top performers across industries while considering environmental, social, and governance factors.

- Technology stocks are favored in ESG funds due to being cleaner industries, with IT stocks accounting for over 30% of allocations in some funds.

- Investor interest in ESG funds remains strong despite financial advisors pulling back from recommending them.

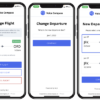

AI Technology Revolutionizes Airlines’ Operations with NLX’s $12 Million Funding

- NLX, an American enterprise AI provider, raised $12 million in Series A funding for operational expansion and development efforts, with JetBlue Ventures contributing to the round.

- NLX utilizes generative AI, cloud software, and conversational AI technology to help airlines enhance customer service by allowing passengers to conduct tasks independently through various mediums.

- The funding round was led by Cercano, Thayer Ventures, and HL Ventures, with JetBlue Ventures being an initial investor, aiming to empower companies to provide seamless self-service experiences.

Climate Tech Future: Avaana Capital Predicts Tomorrow’s Tech Sector Will Be Dominated by Climate Tech

- Climate-tech is predicted to be the future equivalent of the current tech sector, with a focus on sustainable solutions for climate change and resource scarcity.

- Venture capitalists are increasingly recognizing the urgency of investing in climate-tech startups due to the escalating threats of climate change.

- Startups in the climate-tech sector are gaining attention from investors, with a focus on large outcomes and opportunities for impactful solutions.

Greenlyte Carbon Technologies Secures Impressive $11.5M in Pre-Series A Funding Round

- Greenlyte Carbon Technologies secures $11.5 million in pre-Series A funding round to scale its direct air capture solution

- Funding sourced from Earlybird Venture Capital, Green Generation Fund, Carbon Removal Partners, Dr. Udo Jung, and Partech

- Funds to be used for team expansion, technology development, deployment, and cost reduction

- Company has raised over €20 million in total, showcasing strong market trust and progress

- Greenlyte’s innovative approach generates hydrogen while removing CO2, setting them apart in the direct air capture space

Greenlyte Carbon Technologies Secures $11.5M in Pre-Series A Funding

Greenlyte Carbon Technologies, a pioneering direct air capture startup, has successfully closed a pre-series A funding round, raising a substantial amount of €10.5 million ($11.5 million) to accelerate the scaling of its innovative solution. Read more

Tech Funding Challenge Supported by Melinda French Gates Aims to Empower Teens in Navigating a Tech-Driven World

- Melinda French Gates supports a funding challenge to aid teens in navigating the digital world

- Young Futures, a new nonprofit, is hosting funding challenges to promote digital wellbeing for youth

- Two $1 million funding challenges per year will support organizations aiding youth wellbeing

- The first challenge, “Lonely Hearts Club,” focuses on fostering teen social connection

- Pivotal Ventures, Susan Crown Exchange, and The Goodness Web collaborate to fund Young Futures for youth mental health and wellbeing

Melinda French Gates Backs Young Futures in Tech Funding Challenge

In a world where technology plays an increasingly dominant role in the lives of young people, the need to navigate the digital landscape safely and effectively has never been more critical. Read more

Climate-Tech Funding Launches for Sustainability Venture Studio, Seeking Entrepreneurs Passionate about Climate Solutions

- NOW, a Sustainability Action Venture Studio (SAVES), has officially launched to foster innovation and entrepreneurship in India’s sustainability and climate-tech sectors.

- The company plans to invest $250,000–500,000 in each of 3–4 deep tech sustainability and climate tech startups in the next 12–18 months.

- NOW will provide finance, mentorship, product-market fit, access to market opportunities, corporate partnerships, and access to climate-tech experts to assist founders.

Women Entrepreneurs Fund: GetVantage Unveils Rs100 Crore ‘Rise-Up Fund’ to Empower Female Business Owners

- GetVantage launches Rs100 crore ‘Rise-Up Fund’ for women entrepreneurs

- Funds disbursed through GetGrowth Capital, Varaniums Debt Fund partnership, and other NBFCs/AIFs

- Hyundai’s Ioniq 5 drive before mass-market EVs

- Google’s underestimation of LLMs in Gemini

- Seetha Kumari wins INR33 crore arbitral award against Bajaj Finance

Introducing the Rise-Up Fund by GetVantage for Women Entrepreneurs

GetVantage, a prominent player in the funding ecosystem, has recently launched a groundbreaking initiative called the ‘Rise-Up Fund’ specifically designed to support women entrepreneurs in their business endeavors. Read more

Women Start-Up Funding in Ireland Takes a Dive

- Women-founded start-up funding in Ireland dropped by roughly 60% last year, with funding falling to €93m from a record €234m in 2022.

- Despite a record number of successful fundraising deals by women-founded start-ups, the overall funding level significantly decreased.

- The TechIreland report attributes the funding drop to global decline in start-up funding and macroeconomic challenges faced by Irish tech companies.

- Average deal size for women-led start-ups decreased by 50% last year, aligning with the overall drop in funding for start-ups in Ireland.

Startup Funding Dips by 18% to $121 million in This Week’s ETtech Done Deals

- Startup funding dips by 18% to $121 million in the week of March 2 to March 8, 2023

- Data from Tracxn shows companies in seed, early, and late stages raised $147 million from 33 rounds

- Top three active investors were Elev8 Venture Partners, Alpha Wave, and Panthera Growth Partners

- Stories range from Google’s Gemini underestimation to Exicom IPO and a significant arbitral award

- Hyundai’s Ioniq 5 spin-off and potential Disney-Reliance merger impact Jio’s 5G dreams

Startup Funding Dips: A Closer Look at the Recent Trends

In the dynamic world of startups, funding plays a crucial role in nurturing innovative ideas and driving growth. Read more

D2C Apparel Funding: Bummer Secures Rs 9.25 Crore Investment from Nikhil Kamath’s Gruhas

- D2C apparel firm Bummer raises Rs 9.25 crore led by Nikhil Kamath’s Gruhas

- Funding round included participation from Fluid Ventures, a D2C-focused venture firm

- Bummer had previously secured Rs 5.5 crore in seed funding from Beenext Asia

- The funding was entirely primary, indicating new capital infusion

- Beenext Asia has invested in other notable firms like NoBroker and BharatPe

Bummer Secures Rs 9.25 Crore Funding Led by Gruhas

In a significant development for the direct-to-consumer (D2C) apparel industry, Bummer, a prominent player in the sector, has successfully raised Rs 9.25 crore in funding. Read more

Quantum Computing Funding Round Welcomes Chevron as Major Contributor

- Chevron Technology Ventures joins $100 million funding round for quantum computing provider OQC, aiming to harness quantum computing for the energy sector

- OQC’s quantum computing technology offers groundbreaking opportunities for the energy industry, including catalyst development and network efficiency optimization

- Quantum computing in the energy market projected to grow at a CAGR of 37.9%, facilitating discovery of new materials for lower carbon products

- OQC launches OQC Toshiko, a 32-qubit platform for enterprise-ready quantum computing, aiming to offer hybrid quantum and high-performance computing

- Funding round led by SBI Investment includes existing investors, marking UK’s largest Series B in quantum computing; Quantum computing seen as a game changer for various sectors

Exploring Chevron’s Investment in Quantum Computing Funding

In an exciting development for the energy sector, Chevron Technology Ventures, a part of Chevron Corporation, has recently participated in a $100 million Series B funding round for quantum computing provider OQC. Read more

Women-led start-ups make history by securing $23 billion in funding, breaking records: Report

- Women-led start-ups have raised $23 billion in funding so far, with $100 million raised in the first two months of 2024.

- Women-led startups account for 14.8% of the overall tech funding pie in India.

- Funding for women-led startups in 2023 fell by 75% compared to 2022 due to various factors.

- In 2023, 13% of the overall funding in the domestic tech space came from women-led startups.

Online Notarisation Solution Legitify Secures €1.5M in Seed Funding

- Legitify secures €1.5M Seed funding for its online notarisation solution

- Founded in 2020 in Stockholm, Sweden, by Aida Lutaj and Arko Ganguli

- Offers online document certification and notarization transcending traditional boundaries

- Funding led by Verb Ventures, with contributions from other investors

- Plans to expand product offerings, introduce AI enhancements, and reach new markets

Revolutionizing Legal Processes with Legitify’s Online Notarisation Solution

In a digital age where convenience and efficiency are paramount, the need for innovative solutions in the legal industry has never been more pressing. Read more

Ayurveda Experience funding soars to $27 million with backing from Jungle Ventures

- Ayurveda Experience secures $27 million in funding led by Jungle Ventures, with investment from Sidbi Ventures, Anicut Capital, and Sharrp Ventures.

- The funding round also involved the Mariwala Family Office, associated with consumer goods major Marico.

- Various stories and topics are discussed, including Hyundai’s Ioniq 5, Google’s Gemini project, and the potential impact of a Disney-Reliance merger on Jio’s 5G plans.