- Nigeria’s Moove secures $100 million in funding, ranking among the top 10 global fintech funding in Q1 2024

- The funding was part of the $466 million raised by tech startups in Africa in the first quarter, with Moove leading the pack

- Moove’s Series B funding round was led by Uber, marking Uber’s first major investment in Africa

- The investment brings Moove closer to unicorn status with a $750 million valuation and will be used for expansion into new markets

- Moove operates in 13 cities across six countries and plans to expand to 16 markets by the end of 2025

Nigeria Fintech Funding: Moove’s Impressive $100 Million Raise

In the fast-paced world of financial technology, Nigeria’s Moove has made a significant mark by securing a position in the top 10 global fintech funding list for the first quarter of 2024. This achievement was unveiled in the Q1 2024 State of Fintech Report by CB Insights, showcasing Moove’s remarkable $100 million funding round in March.

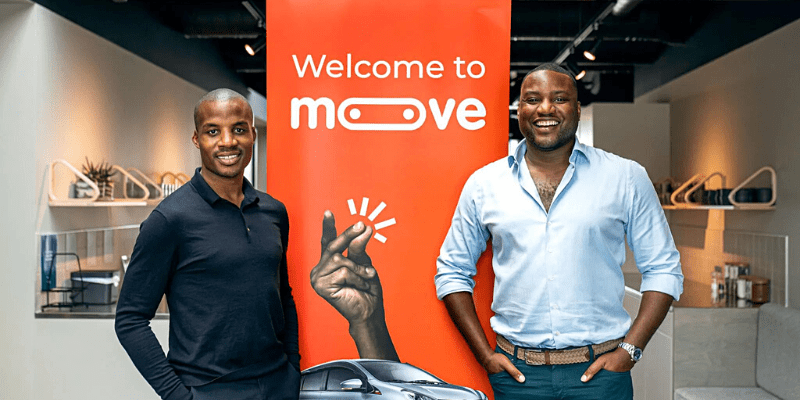

Moove: A Rising Star in Fintech

Moove, a Nigerian mobility financing company, captured attention with its substantial funding raise, which not only positioned it at joint 8th in the global fintech funding rankings but also marked Uber’s first major investment into Africa. The $100 million investment led by Uber underscores the growing interest in Africa’s fintech landscape and propels Moove closer to unicorn status with a valuation of $750 million.

The funding injection serves as a catalyst for Moove’s expansion plans, particularly in launching into new markets. Presently operating in 13 cities across six countries, including Nigeria, South Africa, Ghana, the U.K., India, and the UAE, Moove aims to expand its reach to 16 markets by the end of 2025. This strategic move aligns with the company’s vision to broaden its vehicle financing platform and solidify its position as a key player in the mobility financing sector.

Related Video

Global Fintech Funding Landscape

While Moove’s $100 million raise made headlines in the fintech arena, it is important to note the other frontrunners in the global funding race for the first quarter of 2024. The United Kingdom’s Monzo led the pack with a staggering $431 million funding round in March, securing a significant 5.1 per cent contribution to the total fintech funding for the quarter and attaining a valuation of $5.1 billion.

Following closely behind, the USA’s Flexport raised $260 million in convertible notes, highlighting the diverse sources of funding in the fintech sector. American fintech companies like Bilt Rewards and Kore.ai also made notable strides with $200 million and $150 million raises, respectively, emphasizing the robust investment environment in the industry.

African Tech Startup Ecosystem

Within the African tech startup landscape, Moove’s funding prowess shone brightly, accounting for 24 per cent of the total $466 million raised by tech startups on the continent in the first quarter of 2024. This dominance solidified Moove’s position as a key player in Africa’s burgeoning tech ecosystem, showcasing the region’s potential for innovation and growth.

Kenya’s Roam emerged as another significant player in the African tech funding scene, securing $24 million in funding, albeit trailing behind Moove’s impressive raise. The influx of investment into African tech startups underscores the increasing interest and confidence in the continent’s entrepreneurial spirit and technological advancements.

Moove’s $100 million funding milestone not only cements its position as a rising star in Nigeria’s fintech landscape but also underscores the broader trends shaping the global fintech funding arena. As the company sets its sights on further expansion and market penetration, its success story serves as a testament to the innovation and growth potential inherent in Africa’s fintech sector.

Links to additional Resources: