- Climate tech funding dip poses threat for capital-intensive startups

- Capital flow into mature sectors, while budding ventures struggle for investments

- Climate tech deal activity down 14% in 2023, but outperforming broader tech market

- Government incentives, like the Inflation Reduction Act, supporting growth in the sector

- Importance of creative funding sources, target markets, and patient investors for climate tech startups

Climate Tech Funding Challenges

Climate tech funding has always been a critical aspect of the industry, enabling startups to innovate and develop solutions to combat climate change. However, recent data indicates a dip in funding for climate tech ventures, posing challenges for capital-intensive startups. While this trend may raise concerns, it’s essential not to panic but instead strategize and adapt to the changing landscape.

State of Venture Capital in Climate Tech

The recent report by Silicon Valley Bank (SVB) sheds light on the state of venture capital investing in the climate tech sector. Despite a 14% decrease in deal activity in the industry from its peak in 2021, climate tech is performing better than the broader tech market, which experienced a 24% decline. Within the climate tech sector, different trajectories are evident across various subsectors. For instance, food and agriculture startups are facing challenges due to years of instability, while carbon capture and removal companies, along with climate data startups, are experiencing significant growth.

Strategies for Climate Tech Startups

In the face of declining funding, climate tech startups must adopt strategic approaches to navigate the current landscape. Panelists at a recent SVB-hosted event emphasized the importance of leveraging creative funding sources and incentives. Companies that can tap into all available resources and incentives have a competitive edge in securing the necessary capital to sustain their growth. It is crucial for startups to identify a target market early on and ensure there is demand for their products at a viable price point. This approach not only justifies investments in production but also attracts potential investors looking for market validation.

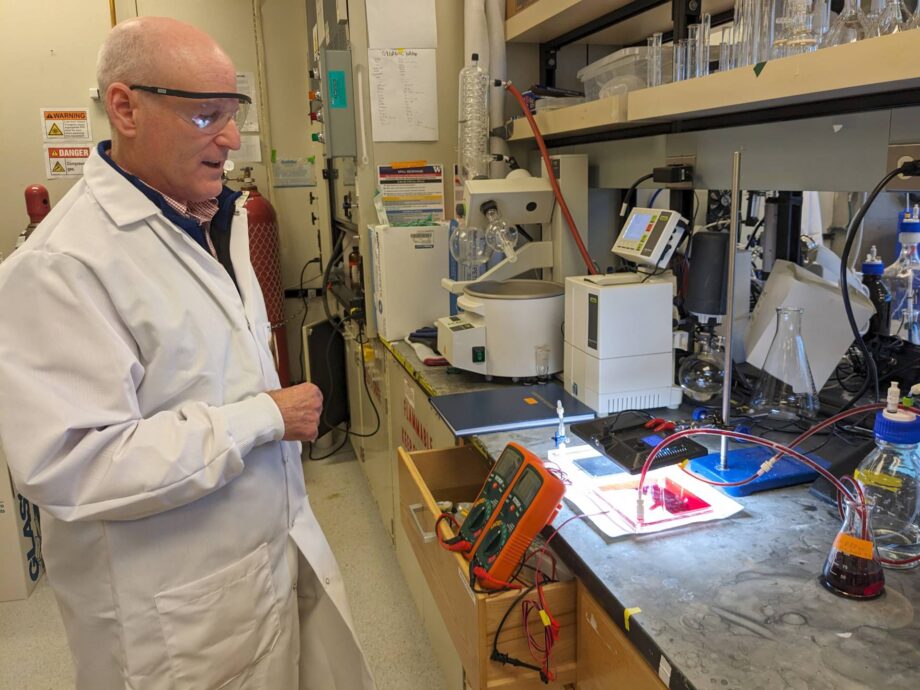

Related Video

Regional Climate Tech Innovation

The Pacific Northwest has emerged as a hub for climate tech innovation, with Seattle being recognized as one of the top U.S. cities for climate tech startup activity. According to PitchBook data analyzed by Revolution, companies in the Seattle area secured $240 million in funding last year. This highlights the region’s growing influence in the climate tech space and the potential for further investment and growth opportunities.

While the dip in climate tech funding may present challenges for capital-intensive startups, it is crucial for entrepreneurs in this sector to remain resilient and proactive in seeking alternative funding sources and strategic partnerships. By adapting to the evolving funding landscape and leveraging government incentives and market opportunities, climate tech ventures can continue to drive innovation and make a positive impact in the fight against climate change.

Links to additional Resources: