- Energy startup funding is a critical challenge for climate tech companies, requiring large cash infusions beyond typical venture investments.

- Rondo Energy, a company producing thermal energy batteries, secured funding through a unique model involving philanthropic grants.

- Climate tech startups face a “commercial valley of death” when transitioning from prototype to selling finished products, hindering funding opportunities.

- Breakthrough Energy Ventures and the European Investment Bank provided project finance to Rondo Energy, showcasing a new funding template.

- The goal is to prove the viability of Rondo’s thermal batteries in replacing fossil fuels and to create a roadmap for future investments in similar technologies.

Unlocking Funding for Energy Startup: The Rondo Energy Case Study

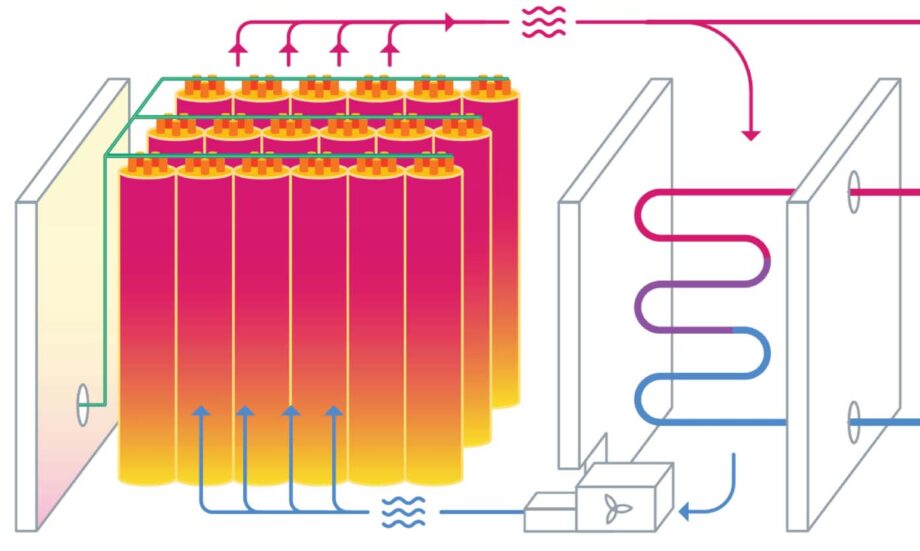

In the world of climate tech startups, securing funding can be a daunting task, especially for those involved in hardware development. The need for significant financial injections to scale up operations and bring innovative products to market often surpasses what traditional venture investors can offer. This challenge is exacerbated by the so-called “commercial valley of death,” a critical phase where startups struggle to transition from prototypes to full-scale production and commercialization. However, a recent funding deal involving Rondo Energy, a company specializing in thermal energy batteries, sheds light on a new avenue for securing capital: philanthropic grants.

The Funding Conundrum in Climate Tech Startups

Climate tech startups like Rondo Energy face a unique set of challenges when it comes to fundraising. Traditional venture investors are often hesitant to commit at a stage where technical risks have been mitigated, as the potential returns may not be as high. On the other hand, infrastructure investors, who typically support projects of this scale, are wary of investing in first-of-a-kind technologies due to perceived risks. This dilemma, commonly referred to as the “valley of death,” has become a pervasive issue in the climate tech sector, leading to a scarcity of funding options for startups at critical growth stages.

A New Funding Paradigm: Philanthropic Grants

The landscape of energy startup funding is evolving, with philanthropic grants emerging as a viable alternative to traditional investment models. The recent deal involving Rondo Energy and Breakthrough Energy Catalyst, in collaboration with the European Investment Bank, exemplifies this innovative approach. By providing €75 million in project finance for the installation of Rondo’s thermal batteries, the funding aims to demonstrate the viability of the startup’s product in replacing fossil fuels across various industries.

Related Video

Catalyst for Change: The Role of Grants in Facilitating Customer Adoption

What sets this funding arrangement apart is the strategic use of grants to address a critical late-stage concern: customer adoption. While grants are not uncommon in the climate tech sector, they are typically allocated at earlier stages when core technologies are still in development. In the case of Rondo Energy, Breakthrough Energy Catalyst’s grant is intended to support the deployment of commercial-scale applications, bypassing the need for extensive testing or validation.

Paving the Way for Future Investments and Industry Growth

By leveraging philanthropic grants to drive customer adoption, Rondo Energy and its partners are not only advancing the deployment of innovative energy solutions but also laying the groundwork for future investments in similar technologies. The successful implementation of Rondo’s thermal batteries across diverse industrial sectors is expected to provide a blueprint for infrastructure investors, demonstrating the soundness of such projects and mitigating perceived risks.

The funding deal involving Rondo Energy represents a paradigm shift in the energy startup ecosystem, showcasing the transformative potential of philanthropic grants in overcoming funding barriers and accelerating the adoption of groundbreaking technologies. As the climate tech sector continues to evolve, innovative financing models like the one employed in this case study are poised to drive industry growth and sustainability.

Links to additional Resources: